P2P Crowdlending for Beginners

Introduction to P2P Crowdlending

P2P / Crowdlending investing has grown significantly in popularity over recent years among those looking to invest in their future and generate passive income. But what exactly is known as Peer-to-Peer lending (P2P) or Crowdlending?

What is P2P Crowdlending?

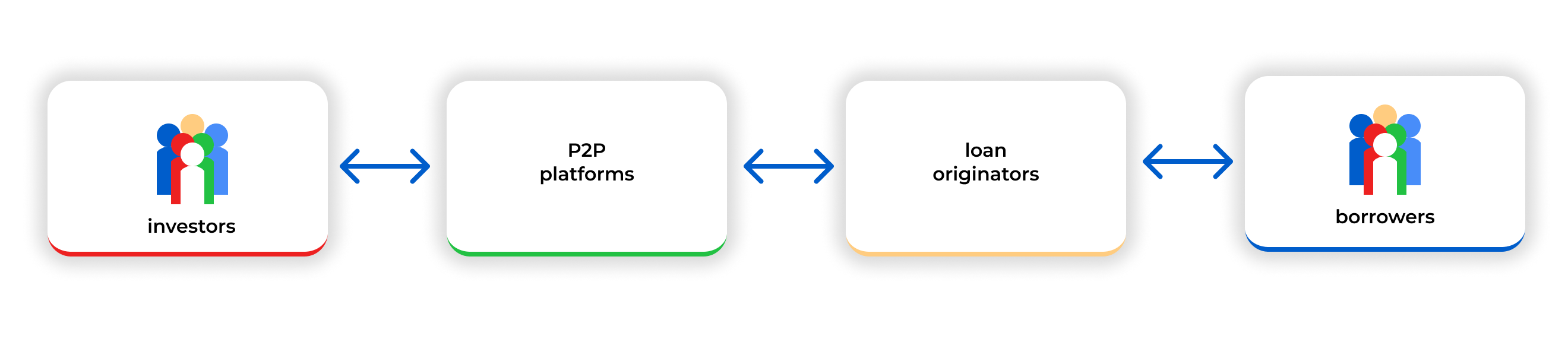

Peer to peer lending (P2P) enables individuals to lend money directly to borrowers without traditional banking intermediaries.

P2P lending is a system that allows people to lend money to others without going through a bank. The platform serves as a technological intermediary that provides the infrastructure and monitors transactions between both parties: borrowers and lenders.

Individual investors can purchase portions of already-issued loans through marketplace lending. This significantly accelerates the investment process and increases loan availability for potential investors. Essentially, P2P lending enables investors to buy into loans that have already been issued by specialized companies known as loan originators.

The P2P platform acts as an intermediary between investors and loan originators. Most platforms partner with multiple loan originators, while some exclusively offer loans originated by their affiliated companies.

The P2P industry has dramatically expanded its product offerings. Personal loans are no longer the only investment option available; investors can now participate in collateral-backed mortgages, student loans, invoice financing, small business loans, and various other financing types.

While these business models can appear complex and the variety of available products might confuse new investors, the core functionality remains clear—providing accessible opportunities for everyone to invest in loans.

How Profits Are Made in P2P Investments?

Many investors wonder, “How can I generate returns from investments in P2P loans?”

Let’s examine a practical example: A borrower receives a €1,000 loan for one year at 30% interest, meaning they must repay €1,300.

This loan is originated by a financial institution using its own capital. The company needs to rapidly increase its loan issuance volume, but €1,300 remains locked for a full year.

This is where peer-to-peer lending enters the picture. The loan originator lists shares of this loan for sale on a P2P lending platform, offering investors a 12% annual return. P2P platforms provide the necessary technology for this process while taking a 3% commission.

An investor pays €1,000 for the loan and waits one year. Meanwhile, the loan originator receives €1,000, which can be deployed to new clients. This arrangement benefits all parties involved.

If the borrower repays successfully and everything proceeds smoothly, investors receive €1,120 after one year (€1,000 principal + €120 interest), while the loan originator earns €150 = €180 – €30 (platform fee).

What if a Borrower Doesn’t Pay Back?

Default situations can occur, leaving investors with non-performing loans in their portfolio.

This means risks transfer from originators to investors, but most originators offer a buyback guarantee.

They guarantee that if payments become delinquent (typically after 30, 60, or 90 days), they will repurchase the loan, returning outstanding principal and accrued interest to investors, thereby handling non-paying borrowers themselves.

While buyback guarantees sound appealing, investors should also verify originators’ capacity to repurchase loans. Originators might lack sufficient funds to buy back all loans during widespread payment delays.

For this reason, monitoring the evolution of investment platforms and their originators is crucial. This is why one of our most sought-after services among clients, within our consulting services, involves helping them create optimized investment portfolios. Additionally, keeping investors informed about market developments enables them to adjust allocations and divest quickly when early signs of liquidity problems or operational risks emerge.

What Other Risks Should Investors Consider with P2P Loans?

It’s important to remember that the P2P lending model involves three main elements: borrowers, loan originators, and P2P platforms. Each carries unique risks beyond payment defaults.

Even if individual loans perform well, loan originators—like any business—can face bankruptcy. During originator insolvency, recovering invested funds may require extended periods.

When P2P platforms onboard loan originators, they should conduct thorough due diligence to verify sufficient financial resources.

Unfortunately, P2P platforms themselves carry risks, and some have been fraudulent schemes offering nonexistent loans with fictitious originators—situations that occurred previously.

We regularly update our clients about market evolution, but each investor should conduct independent research to ensure their chosen platform’s security and legitimacy.

Where Should I Invest and How Much?

We recommend additional steps after investors complete their research and select optimal P2P platforms, or after we help create customized portfolios matching client requirements.

Loan Availability and Cash Drag

Researching loan availability on selected platforms is essential. Your investment amount might exceed available loans, particularly when pursuing maximum diversification through minimal investments across numerous loans.

Cash drag refers to portfolio portions that remain uninvested and generate no returns. This can result from limited loan supply.

For example, platforms like Swaper automatically select loans for investors’ funds. This often causes investment delays, leaving capital idle in accounts without earning interest.

Other platforms, such as Peerberry, have recently experienced significantly higher investor demand than available loans due to attractive returns. Consequently, investors eagerly await daily loan publications that typically exhaust within minutes. The environment resembles a dawn marketplace where premium opportunities attract enthusiastic participants. Furthermore, automatic investment features often struggle under such supply-demand imbalances.

Find some of the most important Crowdlending platforms.

The Offered Loan Terms, Guarantees and Features

Guarantees and risk mitigation tools vary across P2P lending platforms, as do available loan characteristics, fees, and other factors.

Asset liquidity requires careful consideration. If investors need to liquidate portfolios due to financial needs, withdrawing funds from P2P platforms might take months. This highlights why available loan terms must be evaluated.

Some P2P lending platforms provide Secondary Market functionality, enabling investors to liquidate assets faster by selling to other investors at chosen discounts.

If the goal involves investing €10,000 with maximum diversification, this could require approximately 1,000 manual investments and thousands of mouse clicks. Since not everyone possesses this time or patience, P2P platforms offer Auto-invest tools that automatically deploy funds based on investor preferences.

Note that auto-invest features sometimes target sophisticated investors exclusively. Platforms typically require completing questionnaires or tests to determine investor classification. Before depositing significant amounts, verify auto-invest availability after completing full registration processes.

Sum It Up

Before deciding, investors should investigate each P2P platform’s loan availability, available tools, fees, and risk mitigation mechanisms. Importantly, this process should repeat for every platform. Concentrating all funds within a single P2P platform isn’t advisable. Diversification should span multiple platforms, not just different originators and loans.

What to Do When Investment is Made, What to Expect?

Reinvestment Risk

Regarding reinvestment, investors naturally want to continue the process and compound earnings. Here, reinvestment risk becomes relevant.

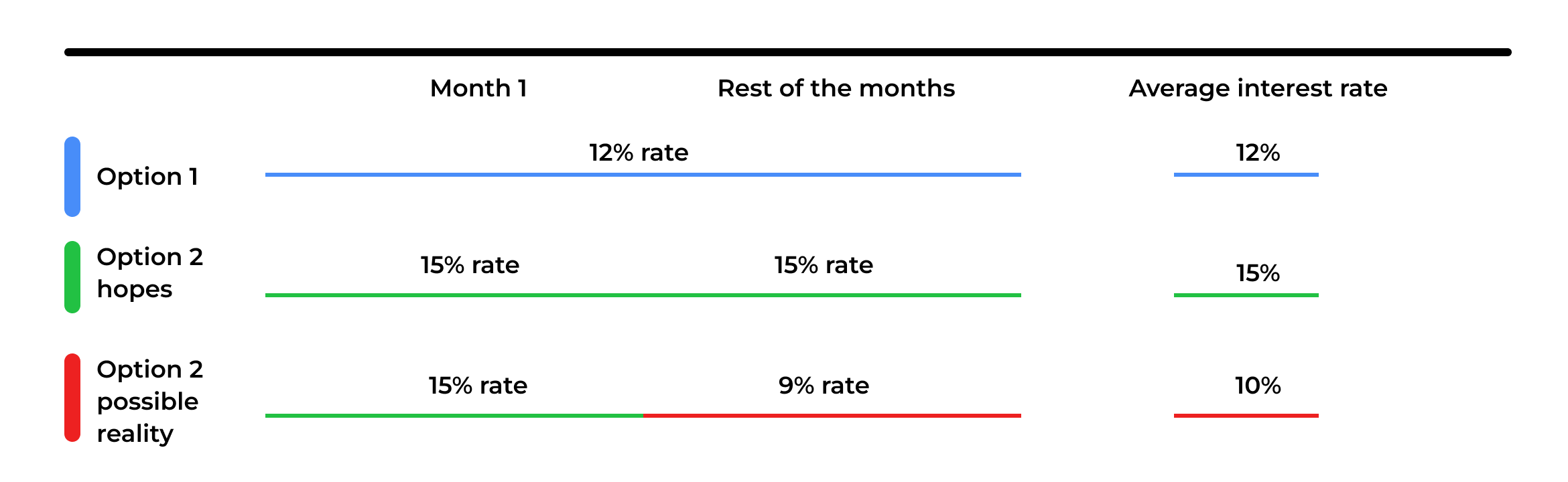

Which loan appears more appealing: Option A (1-year term, 12% promised return), or Option B (1-month term, 15% promised return)? Many would choose Option B for its higher interest rate.

An investor could select the second loan, receive profits after one month, reinvest them, and repeat this process annually. Unfortunately, throughout the year, the best available market loan might only guarantee 9% monthly returns. This means choosing the first loan ultimately proved more profitable—demonstrating “reinvestment risk.”

Every investor differs. Personally, I prefer very short-term loans with continuous reinvestment. This ensures compound interest constantly works in our favor.

By investing monthly, we reinvest the initial capital plus earned interest each month. With every reinvestment cycle, the invested amount (capital + month 1 interest + month 2 interest + … + month n interest) grows progressively larger.

However, this shouldn’t become obsessive, particularly when pursuing passive income that shouldn’t require constant investment monitoring.

Investing for one year or longer and receiving a comfortable 10% sometimes proves worthwhile, avoiding the hassle of repeated platform reinvestment for marginal gains. Naturally, investing €100 involves cents, while millions involve substantial euros. Therefore, investment amounts influence whether we target 90% returns with 10% time commitment or 100% returns with 60% dedication. No fixed rules exist—calculations must consider availability for investment monitoring.

Returns

Promised or advertised returns represent theoretical figures. Actual returns will vary and likely be significantly lower for investors, primarily due to loan repayment schedule deviations and other factors.

Most platforms calculate average advertised returns of available investment opportunities. Basing future expectations solely on these numbers would be unwise.

Risk consideration enables more accurate return expectations. Few platforms provide both historical loan default probabilities and recovery percentages. These parameters facilitate more precise profit estimates. If default probability is 5%, we assume 5% of the portfolio will default.

When loans default, they enter recovery processes aiming to recoup maximum funds. The proportion of uncovered loans is called Loss Given Default. Assuming 40% LGD with both parameters measured annually: Example scenario:

Promised return is 12% with €10,000 investment. Considering LGD and PD (Probability of Default), €300 will be lost annually (€10,000 × LGD × PD). This means instead of €1,200, profits will be €900 (€1,200 – €300). We conclude the risk-adjusted investment return is 9%, not the promised 12%.

Regarding crowdlending, remember funds require time to generate actual profits. After completing investments in offered loans or projects, projects typically need time to reach required funding amounts. Sometimes funding targets aren’t met, returning investor funds without profit.

Conclusion

In P2P lending, the concept is simple: individuals/companies borrow loans while investors lend small portions among numerous participants.

Risks diversify significantly since I prefer lending €1 to 1,000 friends rather than €1,000 to one friend. If that friend defaults, I lose everything. I know that among 1,000 friends, some will delay payments, with some potentially defaulting completely. However, since the other friends will return their amounts with interest, their collective profits can cover the few defaulters.

Therefore, by diversifying across multiple platforms, various originators within them, and numerous loans within those, risks reduce exponentially.

If you purchase a property investing €200,000 and the construction company faces bankruptcy or the property experiences damage, you risk losing €200,000. If I invest across 10 real estate companies, each with 100 housing loans worth €200 each, when individual properties face issues, my overall results remain largely unaffected.

Another advantage involves investing across multiple countries, sectors, and currencies. While investments denominate in euros, dollars, or other currencies, real estate enthusiasts can invest in properties for construction, tourist rentals, or eventual sales. Agriculture-focused investors can support farmers upgrading equipment or expanding operations. Some prefer companies purchasing distressed debt portfolios at significant discounts. Others enjoy supporting startups like coffee shops, beverage companies, or distilleries.

Economics introduces concepts like country risk, currency risk, etc. Investing across different currencies, sectors, and companies helps mitigate risks that cyclically affect all economies. Therefore, dollar depreciation could present attractive opportunities for Europeans, and vice versa, enabling benefits from both investment returns and currency movements.

As mentioned, P2P investing is accessible and executable, making it suitable for virtually anyone. From young individuals investing modest monthly amounts to build significant savings through compound interest over years, to retirees using property sale proceeds to supplement pensions with 10% annual returns.

For smaller investment amounts, starting with established platforms like Mintos provides security through their capitalization, loan volume, track record, and originator management. For diversification or larger amounts, complexity increases, which is why Carlia Consulting offers consultancy services including basic packages and more comprehensive options.

Basic consultancy involves initial conversations understanding client preferences, sectors, amounts, timelines, etc., then designing customized platform portfolios. We typically recommend platforms where we invest personally—platforms delivering solid actual results over 4-5 years, not based on advertised opinions or experts not risking personal capital. With over 400 platforms across different countries available, selecting optimal ones isn’t simple (we invest in approximately 40-50). We show clients our invested amounts and selected platforms to inform their choices.

Advanced consultancy includes portfolio design plus 1-2 months guidance addressing investor questions, modifications after platform testing, or investment expansions following initial results—essentially continuous support services.

Know Our Services and Let Us Help You

🚀 Ready to Start Earning Passive Income?

If you’re looking to grow your money, Crowdlending offers one of the easiest entry points.

Get more information about Crowdlending at my website www.carliaconsulting.com

👉 Top P2P / Crowdlending Platforms I Use

(with referral links)

Lendermarket

Bondster

PeerBerry

Esketit

Income

Robocash

Swaper

EstateGuru

Debitum

Profitus

HeavyFinance

Lande

Crowd With Us

CrowdPear

Scramble

Kiviku Finance

ViaInvest

Twino

Hive5

NordStreet

Nibble

Maclear

Loanch

Afranga

Lonvest

Ventus Energy

Tokenized Green

Civislend

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Crowdlending carries a high risk of capital loss. Always conduct your own due diligence and consider consulting with a qualified financial advisor before investing. Regulations and platform policies change frequently.